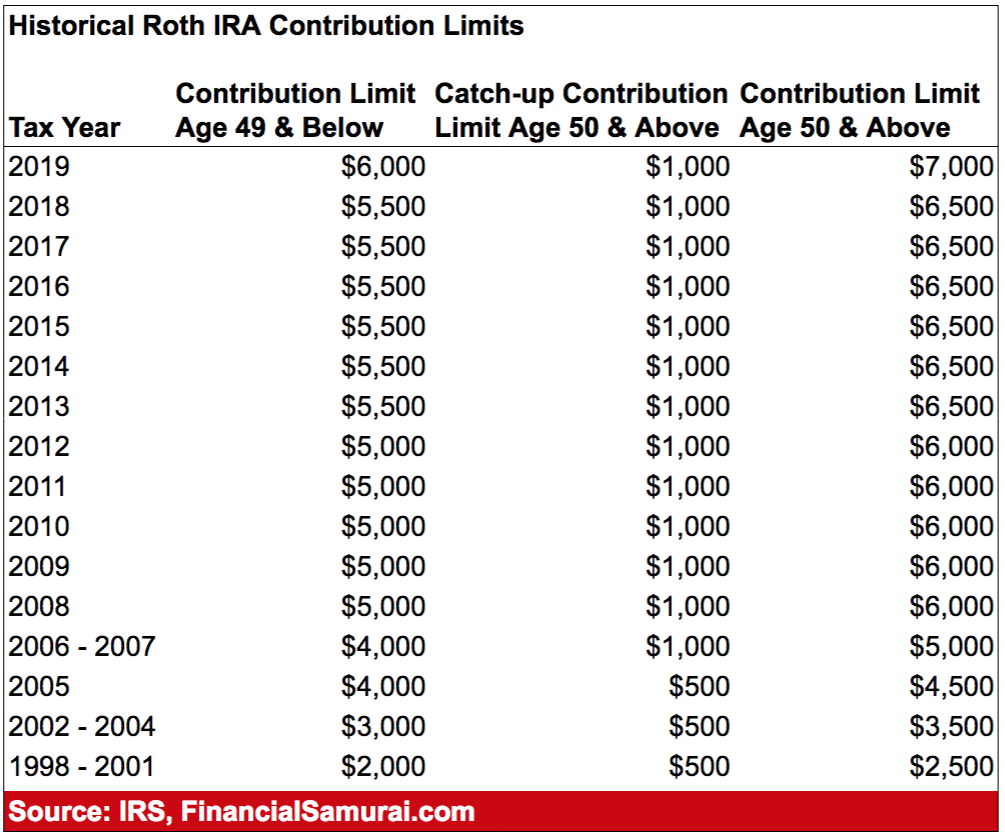

Roth Catch Up Contribution Limits 2025. For 2025, the irs has increased the contribution limit for 401(k), 403(b), most 457 plans, and the federal government's thrift savings plan to $23,000, up from $22,500 in 2025. This figure is up from the 2025 limit of $6,500.

Here are the 2025 ira contribution limits to help you make an informed decision based on your financial goals and income level.

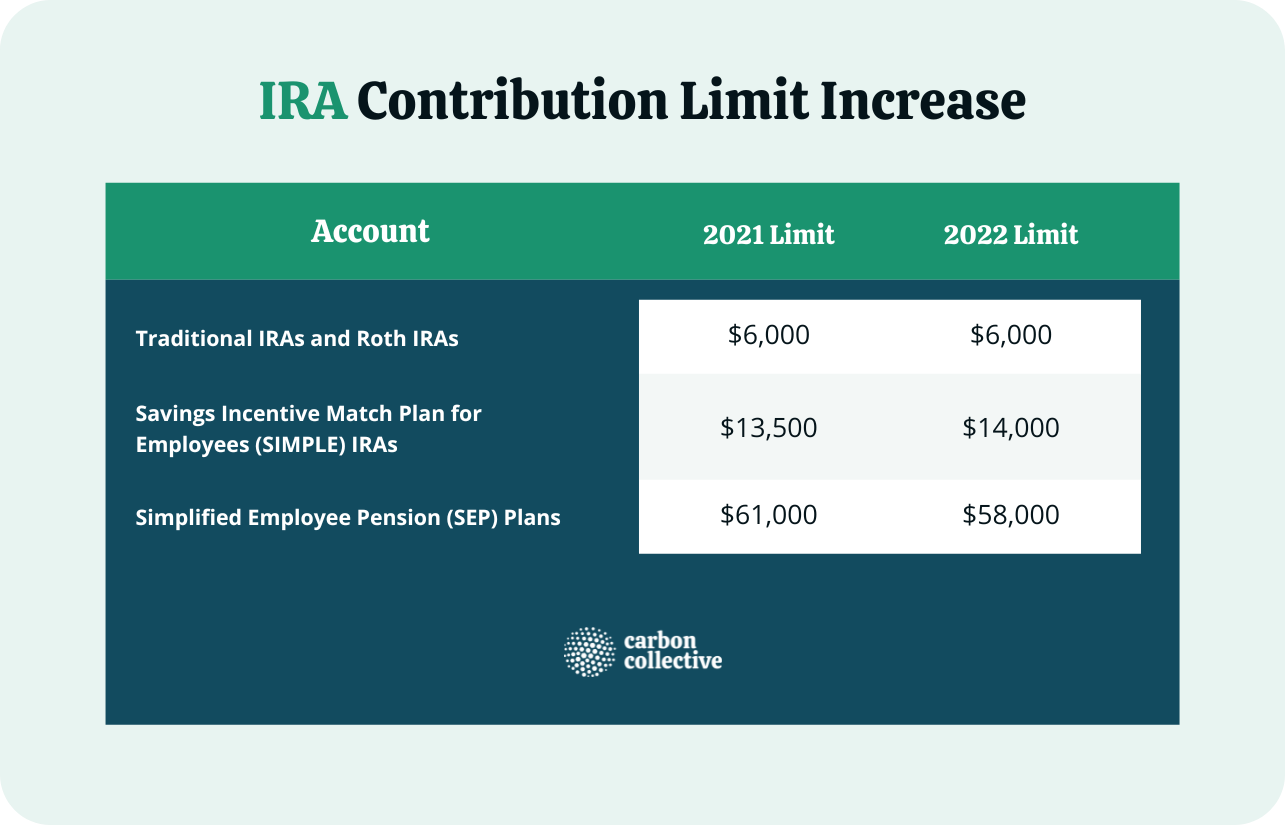

Contribution Limits Increase for Tax Year 2025 For Traditional IRAs, If you open a custodial roth ira and contribute the $7,000 maximum to. With annual contribution limits as high as $23,000 for people under age 50 or $30,500 for those age 50 and up,.

Whatâ s the Maximum 401k Contribution Limit in 2025? Hanover Mortgages, This is an extra $500 over 2025. The roth ira contribution limit increases from $6,500 in 2025 to $7,000 in 2025.

Why I Never Contributed To A Roth IRA But Why You Probably Should, Contribution limits for a roth 401(k) are the same as a traditional 401(k). The cap applies to contributions made across all iras you might have.

Ira Contribution Limit 2025 Reyna Charmian, The roth ira income limit to make a full contribution in 2025 is less than $146,000 for single filers, and less than $230,000 for those filing jointly. If you open a custodial roth ira and contribute the $7,000 maximum to.

401k 2025 contribution limit chart Choosing Your Gold IRA, The roth ira contribution limit for 2025 is $7,000 for those under 50 and up to $8,000 for those 50 or older. Overall contribution limits (age 50 or over) maximum total contributions up to $76,500 ($69,000 annual additions limit, plus $7,500 salary deferral catch up contribution limit).

Roth IRA contribution limits aving to Invest, Starting in 2025, roth 401(k) plans are no longer. Roth ira accounts are subject.

Clarifying the SECURE Act 2.0 Roth CatchUp Contribution Extension GG, If you’re a single filer, you’re eligible to contribute a portion of the full amount if your magi is $146,000 or. 401k catch up contribution limits 2025 over 50 kenna alameda, for 2025, the annual contribution limit for simple iras is $16,000, up from $15,500 in 2025.

ira contribution limits 2025 Choosing Your Gold IRA, 401k catch up contribution limits 2025 over 50 kenna alameda, for 2025, the annual contribution limit for simple iras is $16,000, up from $15,500 in 2025. This is an extra $500 over 2025.

Roth IRA Contribution and Limits 2025/2025 TIME Stamped, The cap applies to contributions made across all iras you might have. Roth ira accounts are subject.

Where We Are With the Roth CatchUp Contribution Provision National, The roth ira contribution limit increases from $6,500 in 2025 to $7,000 in 2025. Contribution limits for a roth 401(k) are the same as a traditional 401(k).